Opinion: Is the PRN system fundamentally flawed?.

Have late submissions undermined PRN values?

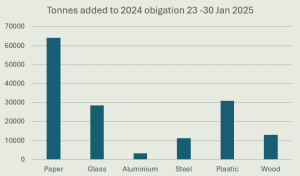

In a recent article from Let’s Recycle [read the whole article here], it was reported that in just seven days (between 23rd and 30th January 2025), 178 companies with an obligation for 2024 registered in the National Packaging Waste Database. The tonnage they confirmed they were obligated to recycle exceeded 30,000 tonnes of plastics and more than 60,000 tonnes of paper. Additional obligations for glass, aluminium, steel, and wood were also recorded.

Why is this so shocking as to make headlines in the trade press? The deadline to provide this information was April 2024, nine months ago. This means for nine months, the market mechanism designed to provide a fair and accurate price for the sales of Packaging Recovery Notes (PRN) and Packaging Export Recovery Notes (PERN) was based on inaccurate data. As a market, the price for PRNs is set by the simple dynamics of supply and demand. With significant levels of demand missing, the price could have been skewed in favour of the buyers and against the sellers—those exact organisations that have been late declaring their obligation.

To put this into perspective, the pricing differential for a tonne of plastics between April 2024 and the week when this additional information was being released into the market was potentially more than £130, meaning that PRNs purchased in January would cost producers almost £4m less than had they been bought in April. In a landscape seeing recyclers pushed to breaking point and many withdrawing from the market, to remove this level of investment from out of the value chain is, as the article suggests, scandalous.

With so much focus placed on producers and exporters for alleged fraud against the system, you would assume the potential penalties for this kind of possible market manipulation would be significant. Yet with fines of £110 for late submission and no legal ramifications, it makes a mockery of the entire system on which so many businesses rely upon.

Without a greater range of sanctions available to the regulator, the proposed Extended Producer Responsibility (EPR) scheme could be flawed from the start.