The WRAP Recycling Infrastructure Presents Huge Investment Opportunities.

The recent recycling infrastructure report from WRAP and DEFRA highlighted huge potential for investment in recycling infrastructure…or did it uncover a huge gap is future capacity which could undermine the goal of a circular economy?

You can download the full report here

Prepare to support the Simper Recycling Policy, WRAP looked at indicative End Destination capacity estimates for waste streams impacted by the packaging reforms. It was intended to act as a visual aid to demonstrate the “forecast capacity investment opportunity”. In essence, it identifies the additional capacity needed to process the increased material generated from the changes in recycling legislation. The goal is to encourage future investment to fill the gap before it is too late.

Separated into the different waste streams, the report looked at the current UK capacity and level of exports recorded via NPWD. It then projected the estimated amount of packaging available going up to 2035, showing the level of excess material that needs to be processed. The results make some interesting reading:

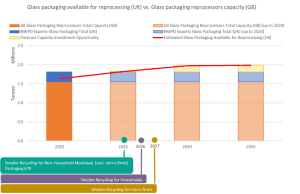

Recycling Infrastructure of Glass Packaging – Remelt and Other

With current capacity standing at just over 1.5m tonnes and approximately 300K tonnes going to export a shortfall of around 200k tonnes per year could open up when the new registration starts to kick in.

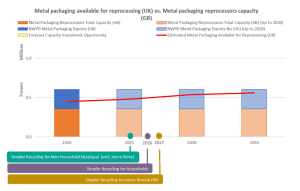

Recycling Infrastructure of Metal Packaging – Aluminium and Steel

With excess capacity already in the system for metal packaging and only a marginal increase in material being collected over the next 10 years, the opportunity for investment in this space is limited. This is interesting as the level of demand from export markets for this type of material has significantly grown in the past 6 months as more and more customers contact us to source metals.

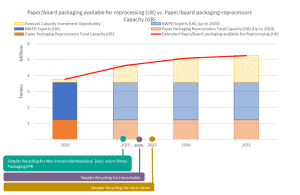

Recycling of Paper/board Packaging

The scale of the challenge for UK-based paper and cardboard is unsurprising, given the volume of material being exported. With the requirement exceeding 5m tonnes by 2035 and UK capacity currently sitting at just over 1m tonnes, export still remains the solution in this space. While the opportunity is evident for local recycling, with the UK mills currently not filling the export gap, what incentive is there for future investment to provide that additional capacity?

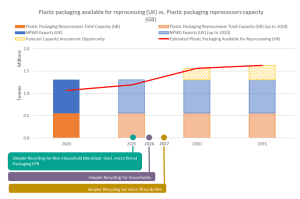

Recycling Infrastructure of Plastic Packaging

The increase in captured material from the implementation of Simpler Recycling is by far the largest across the different waste streams. Rising from around 1.2m tonnes to well over 1.5m tonnes between 2025 and 2030, the need for UK investment in this space is obvious. But like paper exports currently outweigh domestic processing, so if they are not able to capture the excess material now through investment in recycling infrastructure, why would they start in 2025?

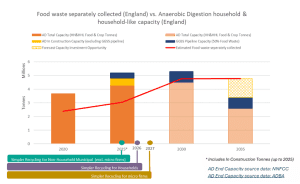

Anaerobic Digestion Infrastructure

The changes in Anaerobic Digestion as an endpoint for food waste is the most complex picture. With a sharp increase generated in 2025 from the introduction of Simpler Recycling in April, it would appear that existing capacity and that in production will more than handle the additional feedstock coming onto the market. However, a decline in capacity for 2035 opens up the gap for investment by this time window. However, why does this significant drop of more than 2m tonnes happen?

The report provides valuable insight into the current and future capacity of the UK recycling infrastructure. Depending on how you view it, you could see tremendous opportunity or stack concern about the investment level and the challenges UK recyclers face. Time will tell, but the continued drive from the Government will continue to shape the recycling landscape even if market forces push back.